Content Outline

- The Hidden Power of Principles

- 5 Investing Principles You Can Rely On

- Practical Application: Implementation Today

- Revelation: Uncertainty is Your Opportunity

- Climax: The Starting Line for Wealth

- Conclusion: Principles Work in Any Scenario

The Hidden Power of Principles

Economic uncertainty is no longer an exception; it has become the new global standard. In a world where markets can shift overnight due to unforeseen global events, most people mistakenly assume that building lasting wealth depends solely on luck, timing, or insider knowledge. But the truth is far more empowering: lasting wealth is built through adhering to a small set of timeless investing principles that stay solid no matter what the global economy is doing.

But the truth is far more empowering: robust, lasting wealth is built through adhering to a small, unshakeable set of investing principles that remain effective regardless of the external global economy. Today’s article reveals exactly why genuine uncertainty isn’t your enemy—it is, in fact, your greatest opportunity—and demonstrates how a few simple, strategic rules can protect, stabilize, and multiply your money even when the world feels overwhelmingly unpredictable. The wealthiest investors on Earth consistently rely on these **investing principles**, not fleeting predictions. These fundamentals form a solid foundation that succeeds in bull markets, bear markets, recessions, inflation cycles, geopolitical shifts, and every scenario in between.

5 Investing Principles You Can Rely On

Investing only becomes complicated when people abandon fundamental truths. Below, we detail 5 investing principles you can apply immediately to build wealth in any economic climate:

1. Diversification Is Your Shield

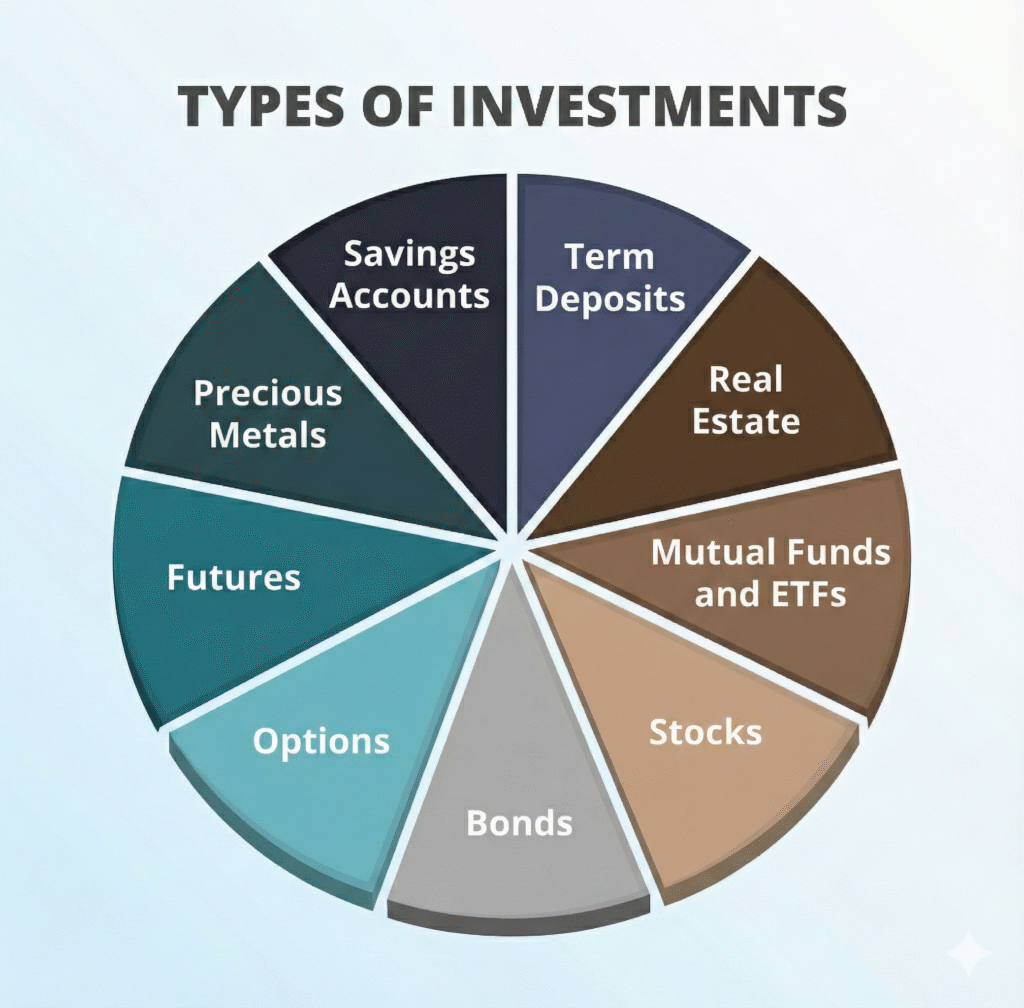

Diversification is the ultimate risk mitigation tool. It fundamentally reduces exposure, strategically spreads risk across different assets, and ensures your portfolio remains balanced even when one specific asset class or sector experiences a collapse. The goal is straightforward: never allow any single investment to determine your entire financial destiny. Smart diversification extends beyond just owning different stocks. It robustly includes:

- Stocks across varying sectors and geographical regions.

- Bonds with varied credit ratings and maturities.

- Real assets (such as real estate or specific commodities).

- Dedicated international exposure.

- A strategic cash reserve for tactical opportunities.

This structure protects wealth during sudden downturns and accelerates subsequent growth during recoveries.

2. Time in the Market Beats Timing the Market

Attempting to predict the perfect buying or selling moment is a demonstrably losing game for 99% of all investors. This emotional, predictive approach is a major source of loss. Meanwhile, patient, long-term investors consistently win because they rely on robust investing principles that eliminate the need for timing the market.

- Market volatility and noise naturally smooth out over extended time horizons.

- Compounding (the 8th wonder of the world) only works effectively when capital remains continuously invested.

- Emotional, reactive decisions are the single greatest destroyer of compounded returns.

Your true competitive advantage isn’t intelligence or market insight—it is relentless, emotionless consistency.

3. Consistency Compounds Power

This consistency is one of the most foundational investing principles for building wealth. Small, manageable contributions, executed repeatedly and automatically, consistently outperform larger, irregular contributions made sporadically. Why is this so powerful? Because compounding does not prioritize the size of your contribution; it prioritizes your discipline. Examples that leverage this powerful compounding effect over time include:

- Automatic investments (Dollar-Cost Averaging – DCA) scheduled weekly or monthly.

- Immediate reinvestment of all generated dividends.

- Consistent monthly contributions to broad, low-cost index funds or ETFs.

The earlier you initiate this consistent system, the better, but critically, it is genuinely never too late to start.

4. Risk Is a Tool — Not a Threat

Many people fear risk because they fundamentally misunderstand its role in investing. Risk isn’t something to be eliminated or avoided; it is a dynamic element that must be strategically measured, managed, and utilized. Understanding risk is one of the crucial investing principles that separates amateurs from the wealthiest, most successful investors:

- Systematically measure potential risk exposure.

- Rationally price risk relative to the potential reward.

- Actively balance targeted risk with expected returns.

- Use risk intentionally to accelerate portfolio growth during strategic opportunities.

Your goal is not to eliminate risk from your life; it is to fundamentally upgrade your rational relationship with it, transforming it from a source of panic into a measurable tool.

5. Knowledge Is the True ROI Multiplier

This fifth principle holds the key to protecting and expanding all the others. Your returns and your safety grow directly in proportion to how deeply your understanding of markets and economics develops. Knowledge, when paired with solid investing principles, is your primary defense mechanism—it protects you from scams, shields you from emotional impulses, and prevents costly, reactive decisions. High-impact learning includes:

- Reading classic, foundational investing books (like The Intelligent Investor).

- Developing a practical understanding of financial statements.

- Methodically studying long-term market cycles and history.

- Systematically following core economic indicators.

Education doesn’t just increase your safety; it exponentially expands your opportunity set and accelerates your path to **financial freedom**.

Practical Application: Implementation Today

To effectively transform these five essential investing principles from abstract theory into daily action, implement these steps immediately:

- Build a Diversified Core Portfolio: Mix stocks, fixed income, commodities, and low-cost global ETFs.

- Automate Consistency: Set up automatic monthly contributions (DCA) and commit to never trying to predict short-term market movements.

- Harness Compounding: Automatically reinvest all dividends and any realized capital gains back into your core assets.

- Define Your Risk: Honestly determine your risk profile and ensure every asset choice aligns with your long-term comfort zone and goals.

- Create a Study Plan: Establish a non-negotiable annual study plan focused on deepening your understanding of investing concepts and market history.

Revelation: Uncertainty is Your Opportunity

In the introduction, we promised you would discover precisely why uncertainty is not your enemy. Here is the revelation: Uncertainty is the force that creates the single best investing opportunities. Huge fortunes are grown precisely when the market is unstable and fear is rampant. This happens because instability allows two things:

- Good, high-quality assets become severely undervalued and cheap.

- Uncertainty drives out undisciplined, emotional investors, leaving opportunities for those who follow solid principles.

Those who follow these solid **investing principles** during times of panic and instability are the ones who consistently prosper.

Climax: The Starting Line for Wealth

The fundamental difference between those who prosper and those who lose everything during volatile uncertain times is not the market environment itself—it is the **principles** they adhere to. You now have access to the same foundational knowledge used by disciplined, global investors. By choosing to apply these principles, you shift your standing from financial vulnerability to one of strategic financial mastery and domination.

Conclusion: Principles Work in Any Scenario

Economic uncertainties will perpetually continue. But now you understand that this fact is irrelevant, because the right **investing principles** function reliably in every single scenario, guaranteeing long-term strategy success.

📚 Protect Your Capital: Elevate Your Mindset

You’ve grasped the essential mechanics. Now, fortify your foundation against speculative noise. Weapons-Grade Wisdom: We strongly endorse adding “The Intelligent Investor” by Benjamin Graham to your permanent library. This book is the most important text in investing history, serving as the foundational reference for Warren Buffett and every truly serious investor. Equip your mind with timeless, market-defying wisdom.

➡️ From Stability to Sustainable Growth: The Investment Leap

You’ve built the confidence necessary for stability. Don’t let your structured foundation sit idle! Your next essential step is to translate that consistent calm into undeniable market gains. Dive into our strategic guide: “Saving Strategies: 6 Steps to Protect Your Wealth in Any Economy” Stop managing stagnation and start commanding growth by making your money work for you.